Share This Post

Securing payment information is essential for companies that process credit card transactions in the modern digital environment. The Payment Card Industry Data Security Standard (PCI DSS) ensures organizations protect sensitive cardholder information from breaches and cyber threats.

So, without PCI DSS compliance, businesses face security vulnerabilities, financial losses, and reputational damage. Therefore, implementing PCI DSS controls strengthens data security, minimizes risks, and builds customer trust.

As cyber threats evolve, businesses must prioritize compliance with PCI DSS to safeguard their operations. Moreover, understanding these controls helps organizations mitigate security risks, prevent fraud, and maintain regulatory compliance. This blog explores PCI DSS controls, their importance, and key compliance requirements. We also discuss how businesses can effectively implement security measures.

Now let’s examine the important facets of PCI DSS controls compliance and how it safeguards financial transactions.

Outline

- Understanding The PCI DSS Controls

- Why Is PCI DSS Compliance Essential for Businesses & Stakeholders?

- What Are The Critical Aspects of Compliance with PCI DSS?

- The 12 PCI DSS Requirements – Ensuring Secure Payment Environments

- How Can Businesses Ensure PCI DSS Compliance?

- Conclusion

Understanding The PCI DSS Controls

PCI DSS controls are security measures designed to protect cardholder data from unauthorized access, fraud, as well as cyber threats. These controls are mandatory for businesses processing, storing, or transmitting credit card information. The PCI Security Standards Council (PCI SSC) enforces these controls to ensure global payment security.

Businesses must integrate PCI DSS controls into their security policies, technologies, and processes to maintain compliance. These controls cover various areas, including network security, access control, encryption, monitoring, and also vulnerability management.

Hence, by implementing these controls, businesses can reduce security breaches, improve data integrity, and enhance trust among customers and financial institutions.

Why Is PCI DSS Compliance Essential for Businesses & Stakeholders?

The importance of the PCI DSS compliance checklist extends beyond regulatory requirements. Various stakeholders, including businesses, customers, financial institutions, and service providers, benefit from compliance. Here’s why adhering to PCI DSS is crucial:

- Prevents Data Breaches: Strong security controls minimize the risk of cyberattacks and unauthorized access to sensitive payment data.

- Ensures Regulatory Compliance: Non-compliance results in hefty fines, legal penalties, and business restrictions.

- Enhances Customer Trust: Secure payment environments build credibility and reassure customers about their data safety.

- Reduces Financial Losses: Data breaches lead to financial damage due to fraud, legal liabilities, and also loss of business.

- Strengthens Cybersecurity Framework: PCI DSS controls align with broader security strategies, thus, making organizations more resilient against evolving threats.

- Protects Business Reputation: A security breach can damage brand reputation, consequently, leading to customer attrition and financial instability.

- Improves Payment Processing Efficiency: Compliance with PCI DSS ensures secure transactions, reducing fraud-related disruptions in payment processing systems.

- Meets Industry & Partner Expectations: Many payment processors as well as banks require businesses to be PCI DSS compliant to engage in financial transactions.

Given these factors, businesses must prioritize compliance to maintain a secure financial ecosystem and ensure seamless transactions.

What Are The Critical Aspects of Compliance with PCI DSS?

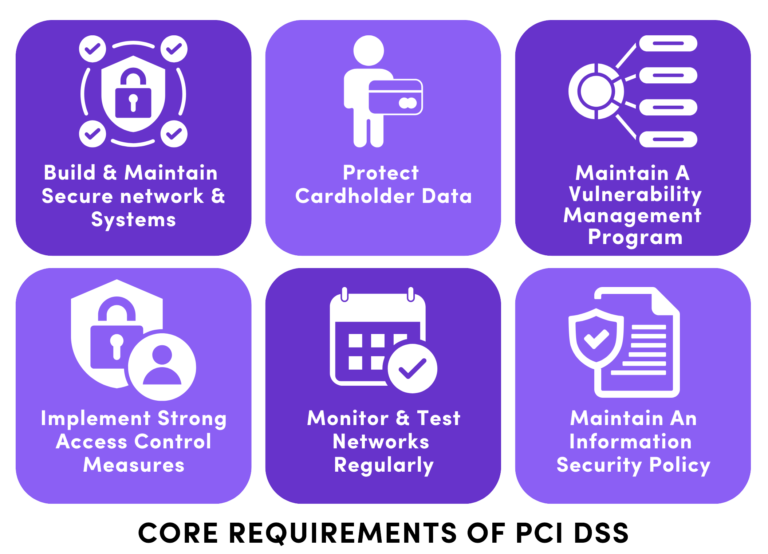

To achieve PCI DSS compliance, businesses must adhere to six primary control objectives, each with specific security requirements. These objectives focus on:

- Establishing and keeping up a secure network

- Safeguarding cardholder information

- Keeping up a vulnerability management program

- Setting up robust access control procedures

- Testing and monitoring networks regularly

- Upholding a policy for information security

Let’s explore these controls and their associated 12 security requirements in detail.

The 12 PCI DSS Requirements – Ensuring Secure Payment Environments

Now, we are going to discuss the 12 PCI DSS requirements explained.

1. Install & Maintain A Secure Firewall Configuration

Firewalls act as the first line of defense against cyberattacks by blocking unauthorized access to payment systems. Businesses must:

- Implement strict firewall rules to allow only legitimate traffic.

- Prevent direct public access to internal networks storing cardholder data.

- Regularly update and test firewall configurations.

2. Avoid Using The Default Passwords and Security Settings Provided by The Vendor

Cybercriminals often exploit default credentials to gain unauthorized system access. Therefore, organizations must:

- Change vendor-supplied passwords before system deployment.

- Implement strong password policies with multi-factor authentication (MFA).

- Disable unused system accounts to minimize risk.

3. Safeguard Stored Cardholder Data

Sensitive payment data must be encrypted to prevent unauthorized access. Key security practices include:

- Encrypting cardholder data using AES-256 encryption.

- Implementing tokenization to replace card data with unique identifiers.

- Moreover, enforcing data retention policies to delete unnecessary stored data for proper PCI DSS compliance.

4. Encrypt Cardholder Data Transmission via Open Networks

Payment data must be secured when transmitted over public networks. Organizations should:

- Use TLS 1.2 or higher for encrypting sensitive data.

- Implement end-to-end encryption (E2EE) to protect transactions.

- Avoid unencrypted cardholder data transmission over public Wi-Fi.

5. Keep Updated Anti-Virus Software to Protect All Systems from Malware

Malware infections can compromise payment security. Businesses must:

- Deploy anti-virus software across all payment-processing systems.

- Regularly update malware definitions and security patches.

- Implement endpoint detection and also response (EDR) to detect advanced threats.

6. Develop And Maintain Secure Systems Applications

Vulnerabilities in software can be exploited by attackers. Hence, responsible organizations must:

- Apply security patches and also updates regularly.

- Conduct penetration testing as well as vulnerability scans.

- Implement secure coding practices for application development.

7. Restricted Access to Cardholder’s Data

Only authorized personnel should access sensitive payment data. Businesses should:

- Implement role-based access controls (RBAC) to limit data exposure.

- Follow the principle of least privilege (PoLP) to restrict access.

- Review access permissions regularly and revoke unnecessary privileges.

8. Identify & Authenticate Access to System Components

Organizations must establish strict identity verification for users accessing payment systems. Best practices include:

- Enforcing unique user IDs for accountability.

- Implementing multi-factor authentication (MFA).

- Logging all system access to detect unauthorized activities.

9. Limit Physical Cardholder Data Access

Physical security is as important as digital security. Hence, businesses should the following steps for PCI DSS compliance:

- Store servers and payment devices in secured locations with controlled access.

- Use surveillance systems and access logs to monitor entry points.

- Secure backup media containing cardholder data to prevent unauthorized access.

10. Track All Network Resources & Cardholder Data Access

Continuous monitoring ensures quick detection of security breaches. So, organizations should:

- Implement SIEM (Security Information and Event Management) systems for real-time alerts.

- Maintain audit logs for all access to cardholder data.

- Conduct regular security audits to ensure compliance.

11. Test Security Procedures And Systems Frequently

Routine security testing helps identify and fix vulnerabilities before attackers exploit them. Key measures include:

- Conducting penetration testing at least once a year.

- Running vulnerability scans quarterly to detect weaknesses.

- Performing incident response drills to prepare for cyberattacks.

12. Keep An Information Security Plan for Every Employee

A strong security policy fosters a culture of compliance within an organization. Businesses must:

- Develop and enforce a documented security policy.

- Conduct regular cybersecurity awareness training for employees.

- Define incident response plans to mitigate security breaches.

Hence, we can say that achieving the PCI DSS compliance checklist requires businesses to implement these 12 security requirements to ensure secure payment environments. These measures protect cardholder data, prevent fraud, and effectively enhance business credibility. Regular monitoring, employee training, and strict access controls are crucial for maintaining compliance.

By proactively securing payment systems, businesses can reduce cyber risks and build customer confidence. So, start implementing PCI DSS controls today to safeguard your financial transactions and business reputation.

How Can Businesses Ensure PCI DSS Compliance?

Businesses must take proactive steps to maintain PCI DSS compliance. Key strategies include:

- Conducting Regular Risk Assessments: Identify vulnerabilities and take corrective actions.

- Implementing Security Awareness Training: Educate employees about PCI DSS requirements and best practices.

- Working with PCI-Compliant Vendors: Ensure third-party service providers adhere to security standards.

- Performing Annual PCI DSS Audits: Validate compliance with security assessments.

- Using Advanced Security Solutions: Leverage encryption, intrusion detection, and secure access controls.

Hence, by implementing these measures, businesses can enhance data protection and avoid compliance risks.

Conclusion

PCI DSS controls are essential for protecting payment data and ensuring compliance. Businesses must implement these security measures to prevent data breaches, reduce financial risks, and enhance customer trust. Hence, understanding the critical 12 PCI DSS requirements and adopting proactive security strategies helps organizations maintain a secure payment environment.

Staying compliant requires continuous monitoring, employee training, and regular security assessments. Moreover, by adhering to PCI DSS certification and standards, businesses achieve regulatory compliance and strengthen their overall cybersecurity framework.

Therefore, consult the experts at Axipro to start implementing these controls today and safeguard your customers’ payment data effectively. We understand that you may face unique challenges while competing with other similar service providers. Hence, to stay ahead, we’ll help to match all the required compliance and certificates for long-term and hassle-free operations.

So, contact us for your specific business needs.