Share This Post

In the current online age, companies that handle transactions cannot compromise on protecting credit card information. The Payment Card Industry Data Security Standard (PCI DSS) was established to safeguard cardholder data as well as reduce fraud risks. Compliance with PCI DSS is essential to maintain trust, prevent data breaches, and adhere to legal regulations.

However, navigating the intricacies of PCI DSS Compliance requirements can seem overwhelming for businesses. This blog will demystify PCI DSS by exploring its core principles, requirements, and best practices for achieving compliance.

So, whether you’re a small retailer or a global enterprise, understanding PCI DSS is crucial for safeguarding customer information. Therefore, let’s dive into the fundamentals of PCI DSS and why it’s vital for your business.

Outline

- Why Was PCI DSS Created?

- Who Needs to Comply with PCI DSS?

- Levels of Compliance

- Core Requirements of PCI DSS

- Several Critical Benefits of PCI DSS Compliance

- Challenges of PCI DSS Compliance

- Best Practices for PCI DSS Compliance

- Steps to Achieve PCI DSS Compliance

- Final Thoughts

- Frequently Asked Questions

Why Was PCI DSS Created?

PCI DSS is the shortened form of the Payment Card Industry Data Security Standard. It is a global security framework designed to protect cardholder information. Major payment brands developed PCI DSS to address rising data breaches.

The framework establishes comprehensive guidelines for securely processing, storing, and also transmitting payment card data.

Cybercrime poses increasing threats to financial data. Data breaches involving payment cards can result in massive financial losses and reputational damage. PCI DSS was introduced to create a unified security approach, reducing fraud risks.

Therefore, companies reduce the risk of cyberattacks and also promote client confidence by following PCI DSS.

Who Needs to Comply with PCI DSS?

PCI DSS must be followed by every company that processes credit card payments. It generally includes merchants, payment processors, and service providers. Compliance applies to businesses of all sizes, regardless of transaction volume.

So, whether you operate an e-commerce platform or a physical store, PCI DSS compliance is mandatory.

Levels of Compliance

PCI DSS classifies businesses into four compliance levels based on annual transaction volumes.

- Level 1: Over 6 million annual transactions.

- Level 2: From 1 to 6 million annual transactions.

- Level 3: From 20,000 to 1 million annual transactions.

- Level 4: Fewer than 20,000 annual transactions.

Businesses must assess their level to determine compliance validation requirements.

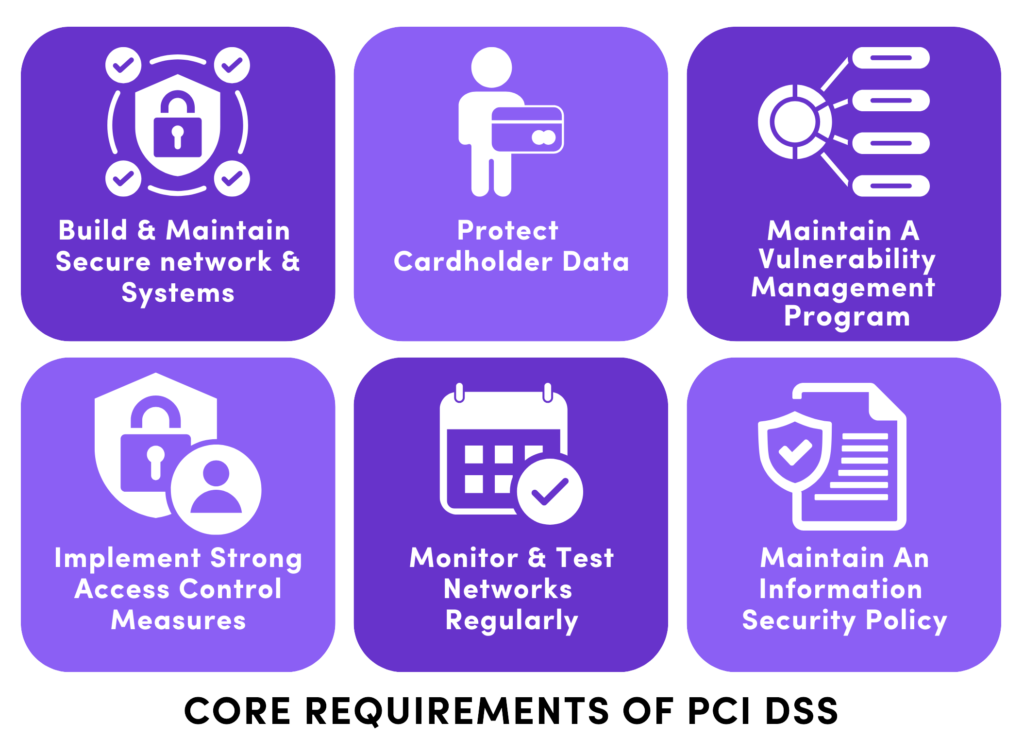

Core Requirements of PCI DSS

PCI DSS outlines 12 key requirements divided into six control objectives. Let’s explore these requirements in detail:

1. Build & Maintain Secure Systems

- Install Firewalls: Ensure robust firewalls protect sensitive data.

- Avoid Vendor-Supplied Defaults: Update default passwords and settings for all systems.

2. Protect Cardholder Data

- Encrypt Data: Use strong encryption to protect stored and transmitted cardholder data.

- Mask Data: Display only the last four digits of card numbers when necessary.

3. Maintain A Vulnerability Management Program

- Use Antivirus Software: Regularly update and monitor antivirus solutions.

- Secure Applications: Develop and maintain secure applications free from vulnerabilities.

4. Implement Strong Access Control Measures

- Restrict Data Access: Limit access to cardholder information based on job responsibilities.

- Authenticate Access: Use multifactor authentication for sensitive data access.

5. Monitor & Test Networks Regularly

- Track Activity: Implement logging mechanisms to monitor system activities.

- Conduct Scans: Perform regular vulnerability scans and penetration testing.

6. Maintain An Information Security Policy

- Create Policies: Develop and enforce a comprehensive security policy.

- Employee Education: Provide best practices for data security training to employees

Several Critical Benefits of PCI DSS Compliance

Enhanced Data Security

PCI DSS establishes a strong foundation for protecting cardholder information. Moreover, compliance reduces the risk of unauthorized access and breaches.

Customer Trust

Consumers value secure transactions. Compliance demonstrates a commitment to safeguarding customer data and fostering trust and loyalty.

Avoiding Penalties

Heavy penalties plus legal repercussions may result from noncompliance. PCI DSS adherence prevents financial and reputational damage.

Competitive Advantage

PCI DSS compliance distinguishes your business from competitors. It showcases your dedication to robust security measures.

Now, if you want proper PSI DSS compliance, you can visit Axipro in this regard.

Challenges of PCI DSS Compliance

- Complexity of Requirements: The detailed requirements may seem daunting for businesses, especially smaller organizations with limited resources.

- Resource Constraints: Compliance often requires investing in advanced tools, staff training, and third-party assessments, which can be costly.

- Continuous Maintenance: PCI DSS isn’t a one-time process. Businesses must continuously monitor and update systems to stay compliant.

- Adapting to Changing Dangers: Cyber dangers are always changing. You can’t ignore that. As a result, companies need to be informed about new threats and modify their security protocols accordingly.

Best Practices for PCI DSS Compliance

Conduct Regular Assessments

Regular self-assessments or audits identify vulnerabilities. To guarantee thorough assessments, work with scanning companies who have been authorized by PCI DSS.

Leverage Tokenization

Tokenization replaces sensitive card data with unique tokens, thus, reducing risks associated with storing payment information.

Implement Strong Authentication

Use multi-factor authentication (MFA) to enhance access control. MFA adds an extra layer of security to sensitive data.

Partner with PCI-Compliant Vendors

Ensure third-party vendors handling payment data meet PCI DSS requirements. Vendor non-compliance can heavily impact your business security.

Provide Employee Training

Educate employees on data security and compliance requirements. Therefore, regular training reduces human error and enhances organizational security.

Steps to Achieve PCI DSS Compliance

Step 1: Determine Your Compliance Level

The first step involves identifying your compliance level based on transaction volumes. Each level has specific requirements for validation and reporting. Hence, this foundational step ensures you understand what is expected from your business. It could be helpful if you are a small merchant or a large enterprise.

Step 2: Complete A Self-Assessment Questionnaire (SAQ)

The SAQ is a critical document that evaluates your current security posture. It consists of multiple sections covering various compliance aspects. Completing this questionnaire properly allows businesses to identify gaps in their systems and processes. Henceforth, choose the SAQ version that aligns with your business operations.

Step 3: Conduct Vulnerability Scans

Regular vulnerability scans are essential for identifying potential weak points in your network. Use PCI-approved scanning vendors to ensure compliance and accuracy. Thus, these scans provide valuable insights into system vulnerabilities, helping you mitigate risks proactively.

Step 4: Implement Necessary Changes

Address any issues uncovered during assessments or scans. So, this might involve upgrading systems, revising security protocols, or training employees. Proper implementation of changes is key to meeting PCI DSS standards.

Step 5: Submit Compliance Validation

Once you’ve addressed all gaps, submit the required documentation to validate compliance. This could include the SAQ, an Attestation of Compliance (AOC), or reports from qualified assessors. Timely submission demonstrates your commitment to security.

Step 6: Maintain Ongoing Compliance

Compliance isn’t a one-time task. Continuously monitor systems, update security measures, and adapt to new threats. Moreover, regular audits, employee training, and updated policies ensure long-term adherence to PCI DSS standards.

Final Thoughts

PCI DSS compliance protects payment card data and builds customer trust. Prioritize security, and your business will reap the benefits of enhanced trust and long-term success.

Proper PCI DSS compliance protects payment card data and builds customer trust. Therefore, by understanding its requirements, businesses can enhance security, mitigate risks, and remain competitive in the digital landscape.

Compliance may seem challenging, but achieving and maintaining PCI DSS compliance is manageable with the right strategies and resources. With Axipro these become easy for businesses.

So, prioritize security, and your business will reap the benefits of enhanced trust and long-term success.

Frequently Asked Questions

What is PCI DSS Compliance?

PCI DSS compliance involves adhering to a set of security standards to protect payment card data and reduce fraud risks.

Who Needs to Comply with PCI DSS?

Any business handling cardholder data, including merchants, payment processors, and service providers, must comply with PCI DSS requirements.

How Often Should Businesses Conduct PCI DSS Audits?

Businesses should conduct regular audits, at least annually, and perform continuous monitoring to ensure ongoing compliance.

What Happens if a Business Fails to Comply with PCI DSS?

Non-compliance can lead to fines, legal consequences, reputational damage, and increased vulnerability to cyberattacks.

Can Small Businesses Achieve PCI DSS Compliance Easily?

Yes, small businesses can achieve compliance by following tailored guidelines like the Self-Assessment Questionnaire (SAQ) for their operational level.